Deltek’s Global Clarity A&E Industry Survey

Share

Now more than ever, it’s imperative that businesses learn how to guarantee their future success, and ensure that they are servicing their clients effectively and efficiently. The 41st annual Deltek Global Clarity A&E Industry Survey is a resource that will help them do just that.

While the world is reeling from the physical but also economic impacts of the events of 2020, it has become even more vital to ensure that your company has the right tools at its disposal for competitive advantage and successful cut-through both now and in a post pandemic scenario.

Architecture and engineering (A&E) firms need to understand the impact of technology on their industry, along with the challenges and benefits of change management. This isn’t ‘nice to have’ information – it’s the key to providing the most important benchmarks needed to help them evaluate their performance and understand how a digital operating model can accelerate the growth of their businesses.

With this in mind, each year, Deltek conducts a survey of firms in the A&E industry to identify key performance indicators (KPIs), market conditions and industry trends. Now, for the first time, it has expanded its research to include A&E organisations across EMEA and APAC.

Surveying 600 decision-makers, the study collected responses on emerging technology trends, attitudes towards digital transformation, existing and future challenges, the role of leadership, benchmarking and KPIs.

Across the EMEA and APAC

The survey included organisations headquartered in the UK, Australia, Germany, Singapore, New Zealand, Norway, Denmark and Sweden. All company sizes were included, from the smaller firms of 20 to 50 employees, right up to those with 5000-plus.

The study uncovered some key issues currently impacting the A&E sector, including how firms are responding to industry challenges, their feelings toward digital innovation, and their plans for business growth.

The findings uncover a strong link between the level of understanding of key technology trends and their value to the business, but differences in opinions between the types and sizes of organisations. The survey also highlights a shortage of quality data that is impeding technology adoption, along with a cautious approach to digitalisation.

- When asked what technology trends they consider most important to their business, respondents said Internet of Things (IoT) (84 percent) and geolocation (83 percent), trailed by big data (69 percent).

- The engineering sector is far more likely (72 percent) to consider AI to be ‘very important’ compared to the architecture sector (44 percent).

- A lack of data maturity may explain why only 34 percent of all respondents consider machine learning to be important to their business.

- Nine out of 10 (89 percent) say they have a full understanding of their digital transformation strategy, while 50 percent describe themselves only as ‘exploratory’ in their digital transformation maturity.

While companies are focused on increasing profitability, there are different perspectives on the best way to achieve this. The survey also shows that the top priorities when starting a project vary significantly from the top project success factors.

- A fifth of A&E firms’ financial leaders cite ‘increasing profitability’ as the greatest challenge they will face in the next three years.

- Respondents’ top three initiatives to address financial challenges in the next three years are business process improvement (21 percent), organisational changes or realignments (19 percent) and better forecasting (13 percent).

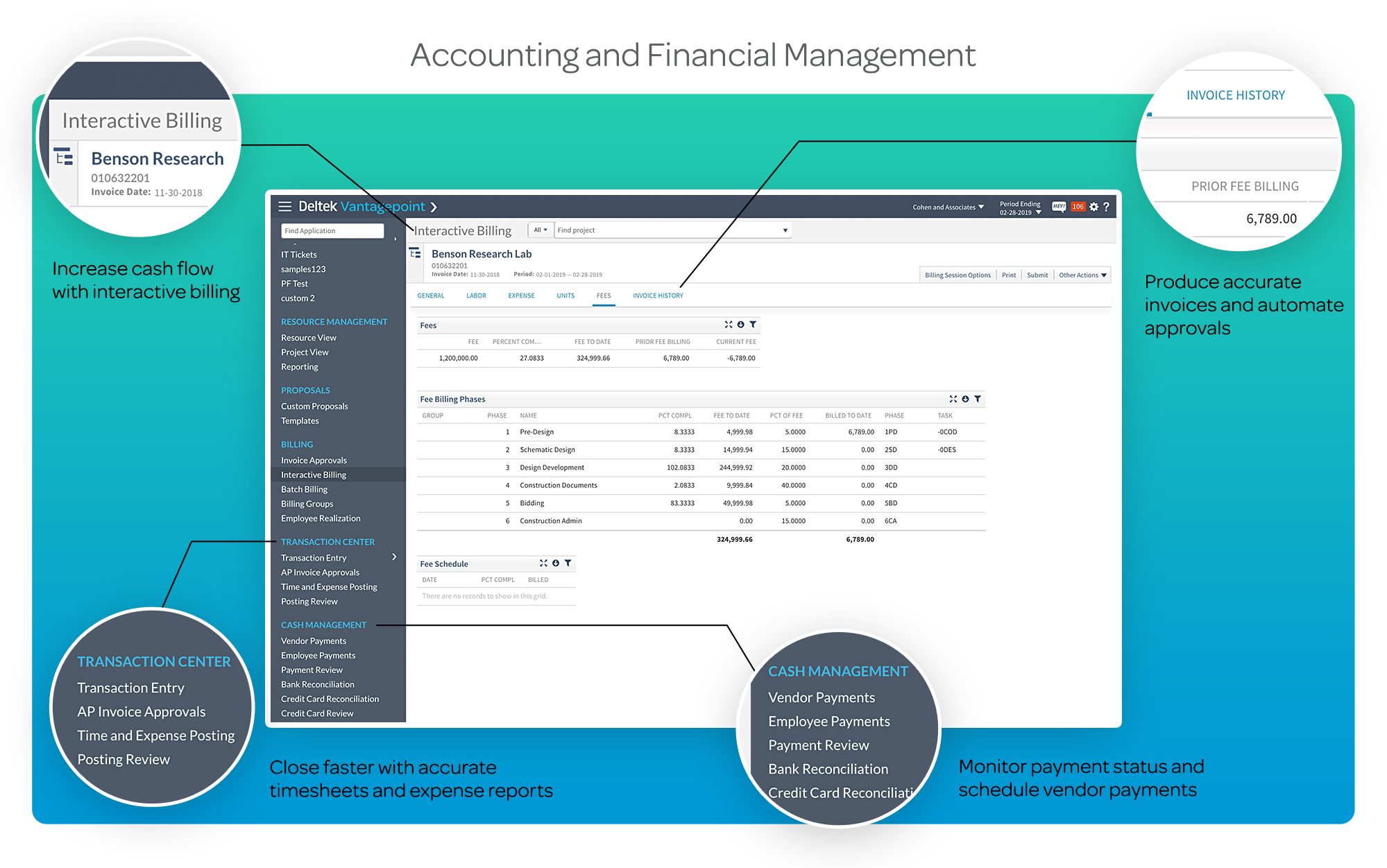

- Accounting and finance are still the most reliant on spreadsheets and manual data entry.

Despite being a key driver for business growth, collaboration levels are still relatively low in the A&E industry. However, the results indicate that business leaders are taking a hands-on approach to their roles.

- A fifth (20 percent) of respondents maintain that the biggest barrier to success is ‘little cross-functional cooperation’.

- Only two percent of respondents describe their firms as ‘completely integrated’.

- In terms of engagement, 44 percent of respondents say they interact most frequently with colleagues in the C-Suite, more than any other job roles.

You can read the full report and see exactly how Australian firms are operating compared with their international counterparts here.

You Might also Like